Forgot their pocket money... again?

Stop the pocket money chaos. 73% of adults fail basic money tests. Bankies teaches real money skills through chores, savings goals, and virtual investing. Be 1 of 10 families to get 3 months free.

Money skills schools don't teach

Every money moment is a teaching moment. Most parents miss them. Bankies captures them all—turning daily interactions into lifelong financial wisdom.

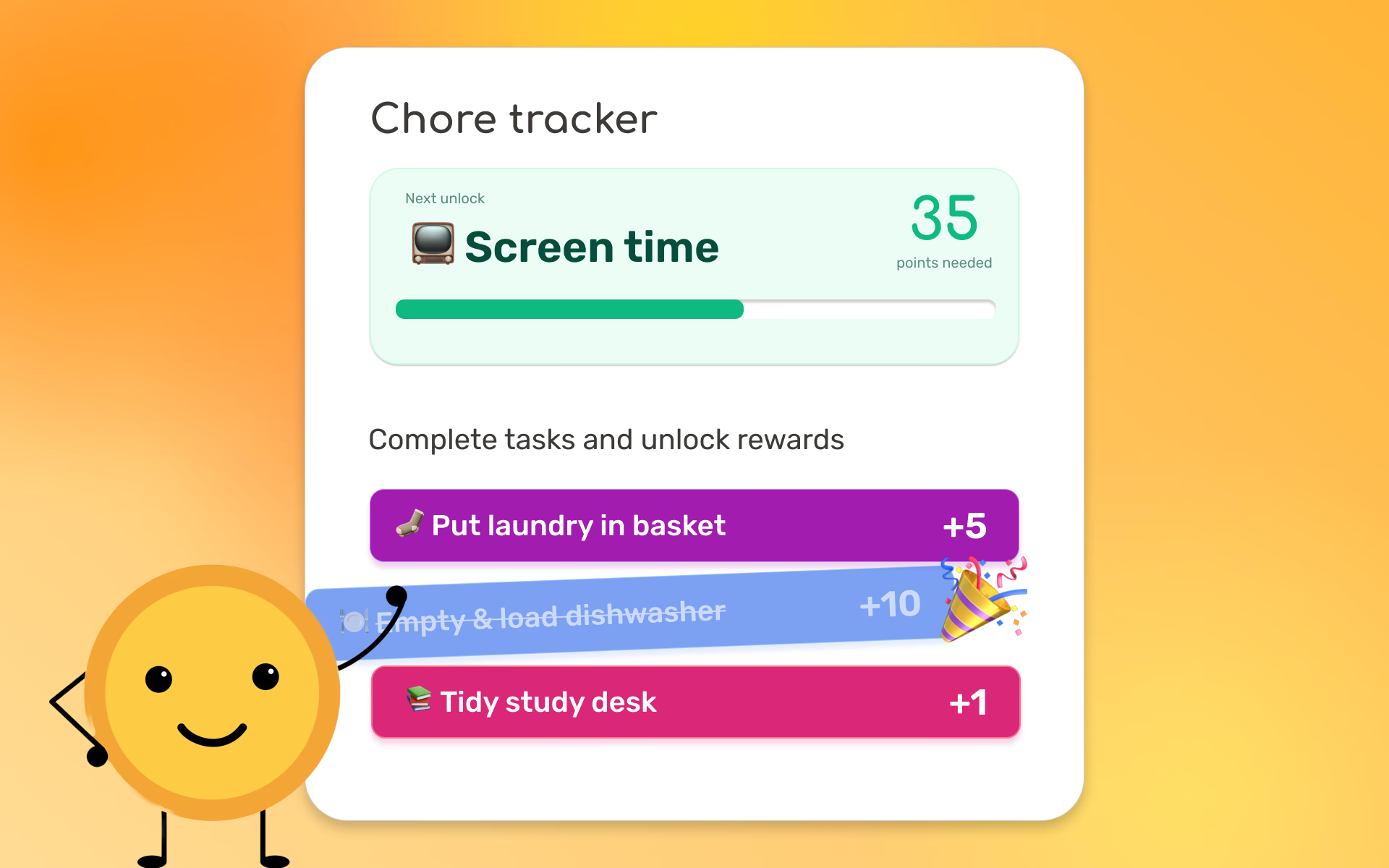

Watch lazy kids become eager helpers. Clear connection between work and reward. Independence grows, arguments shrink.

Simple Start, Powerful Results

From money stress to money confidence in 3 steps

Setup (5 minutes)

Create family profiles and set your first savings goal

Assign Chores

Connect effort to reward. Watch independence bloom.

See Results

Kids who beg to do chores and save money

Built by a parent, for parents

The hardest parenting conversations made easy. No more forgotten allowances, money arguments, or raising another financially illiterate adult.

Never Forget Allowance Again

Automatic pocket money deposits.

Set it once, never think about it again. Regular deposits teach regular habits. Consistency builds trust and financial rhythm.

Parent-Controlled Safety

Complete oversight, zero risk.

No real money, no bank details, no risk. Full parental control with kid-friendly interfaces. Security that lets kids explore safely.

Visible Progress Tracking

Small wins create big momentum.

Kids thrive on progress they can see. Every completed chore, saved dollar, and reached goal becomes a victory that motivates more success.

Automatic pocket money deposits.

Set it once, never think about it again. Regular deposits teach regular habits. Consistency builds trust and financial rhythm.

Complete oversight, zero risk.

No real money, no bank details, no risk. Full parental control with kid-friendly interfaces. Security that lets kids explore safely.

Small wins create big momentum.

Kids thrive on progress they can see. Every completed chore, saved dollar, and reached goal becomes a victory that motivates more success.

Last Call: 10 Founding Families Only

Shape how the next generation learns money. Your kids get 3 months free. You get to influence the future of children's financial education. 10 spots left.

Get 3 Months Free10 spots only • 3 months free • Cancel anytime

Real parents, real results

Kids who understand money beat kids who don't. Every time.

Here's what happens when you start early.

Money used to disappear from their hands. Now my kids race to check their growing balances. The conversation has completely changed.

Sarah J.Mother of two

We turned vacation planning into a family budget project. Even my 5-year-old gets it now. No arguments, just smart choices together.

Emily C.Mother of one

The chore feature is magic. My kids volunteer for tasks they used to avoid. The connection between effort and reward changed everything.

Lisa P.Mother of two

Your Story Could Be Here

Join our founding families. Share your Bankies experience. Help other parents discover what's possible.

Get 3 Months FreeRidiculously affordable for skills worth millions

Join our exclusive early access (10 spots only). 3 months free. Help build the future of kids' financial education. Only 27% of adults pass basic money tests (FINRA study). Don't let your kids become another statistic.

Starter Saver

Perfect for testing the waters.

$1.50/month

- 1 child profile

- 1 parent profile

- Basic pocket money tracking

Super Saver

Everything most families need.

$2.50/month per child

- 3 child profiles

- 2 parent profiles

- Pocket money tracker

- Auto allowance deposits

- Savings goals

- Virtual investing

- Chore tracking & rewards

- Parent dashboard

- Kid-safe interface

- Learning activities

Ultimate Saver

For families who want it all.

$7.50/month

- Unlimited child profiles

- Unlimited parent profiles

- Pocket money tracker

- Auto allowance deposits

- Savings goals

- Virtual investing

- Chore tracking & rewards

- Parent dashboard

- Kid-safe interface

- Learning activities

Quick answers

Questions? I answer personally.

[email protected]

Is the money real?

No. Virtual currency only. All the learning, zero risk. Perfect training ground for real-world money skills.

What ages work best?

Ages 6-14 are perfect, but parents learn too. If they can count, they can start building money skills.

How do we use it together?

You control everything. They explore safely. Every feature sparks conversations about money, work, and goals.

How do chores work?

You set the work and its value. They complete it. Clear connection between effort and reward builds independence.

Multiple kids?

Each child gets their own profile, goals, and progress. Plans scale from one child to unlimited.

How does virtual investing work?

Safe market simulation. Goals that rise and fall like real investments. They learn patience and compound growth without risk.

Is it secure?

Zero bank details required. All data encrypted. EU-hosted. Privacy focused. Complete parental control. Kid-safe by design.

How often should we use it?

Weekly works best. Many families make it their allowance day ritual. Consistency beats frequency.

What if we want to cancel?

Cancel anytime, no hassle. Built by a real parent who gets it. Personal support when you need it.

Ready to Raise Money-Smart Kids?

3 months free. 10 spots left. Help shape the future of kids' finance education while your children learn skills schools won't teach.

Get 3 Months FreeWhy I built this

I kept forgetting my 11-year-old's pocket money. With busy family life, we could never remember what he'd earned or spent.

So we built Bankies together as a weekend project. What started as a simple tracker became something bigger—chores, goals, investing, a kid-safe dashboard. Everything I wished existed for my own kids.

The surprise? How much my son learned about money. He now saves more than he spends, begs to do chores, and asks about investing. Financial lessons that took me decades to learn.

When you join, you get early access to shape something that could change how kids learn about money forever.